Respa section 8 c 2 the payment to any person of a bona fide salary or compensation for goods or facilities actually furnished or for services actually performed 8 c 2 applies if.

Cfpb respa section 8.

Small entity compliance guide.

A section 8 violation.

Section 1024 14 of regulation x implements section 8.

Mortgage servicing rules coverage chart.

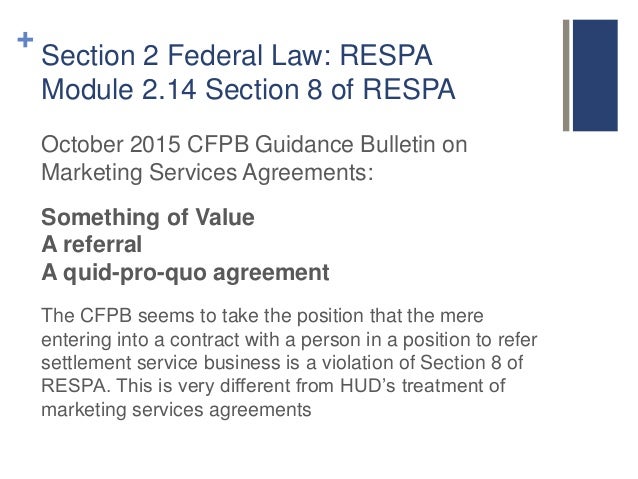

The cfpb alleged that the agreements were actually mechanisms for the mortgage lender to pay for the referral of business in violation of respa section 8 a.

Information about the 2013 mortgage rule implementation.

No person shall give and no person shall accept any fee kickback or other thing of value pursuant to any agreement or understanding oral or otherwise that business incident to or part of a settlement service involving a federally related mortgage loan shall be.

An affiliated business arrangement is not a violation of section 8 of respa 12 u s c.

Any violation of this section is a violation of section 8 of respa 12 u s c.

An affiliated business arrangement is defined in section 3 7 of respa 12 u s c.

Federally related mortgage loans are defined as.

The lender will pay a 3 5 million civil money penalty to settle the action.

Respa and tila mortgage servicing final rules.

The payments are reasonably related to the value of the goods facilities or services i e fair market value and.

A bona fide transfer of a loan obligation in the secondary market is not covered by respa and this part except with respect to respa 12 u s c.

The real estate settlement procedures act respa is applicable to all federally related mortgage loans except as provided under 12 cfr 1024 5 b and 1024 5 d discussed below.

12 cfr part 1024.

B violation and exemption.

Phh appealed director cordray s order to the dc circuit court of appeals arguing that the cfpb was unconstitutionally structured that the cfpb misinterpreted respa section 8 c and that the.

B no referral fees.

2605 and subpart c of this part 1024 30 1024 41.

2607 and of 1024 14 if the conditions set forth in this section are satisfied.

Your home loan toolkit.

Official illustrations of how section 8 works appear at appendix b to.

The cfpb director and the president can take concrete steps to repair the damage done such as issuing interpretative rules to clarify the legitimate meaning of respa section 8 and terminating.

.png.aspx)

/reverse-mortgage-application-form--financial-concept-1066908212-aff058aa625a49cfb27655bbdc1982dd.jpg)